[ad_1]

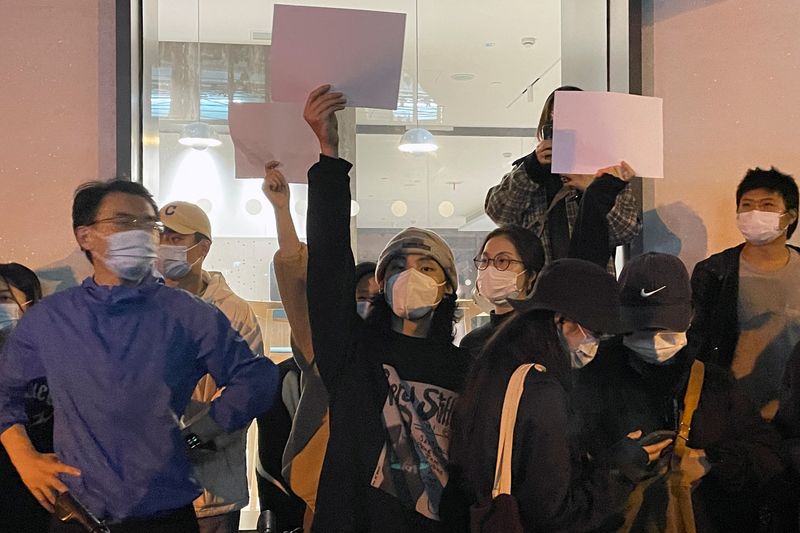

© Reuters. Folks maintain clean sheets of paper throughout an illustration in opposition to COVID-19 curbs following the lethal Urumqi fireplace, in Shanghai, China November 27, 2022. REUTERS/Josh Horwitz

By Jamie McGeever

(Reuters) – A have a look at the day forward in Asian markets from Jamie McGeever.

Buying managers index (PMI) knowledge would be the key financial driver for Asian markets this week, however the tone can be set by the more and more tense political scenario in China.

1000’s of persons are taking to the streets in a number of cities throughout the nation in an unprecedented protest in opposition to the federal government’s stringent COVID restrictions after a lethal house fireplace in Urumqi within the nation’s far west.

The wave of civil disobedience and clashes between protestors and police come amid mounting frustration over President Xi Jinping’s signature zero-COVID coverage. China has reported report new COVID circumstances for 4 straight days.

“Down with the Chinese language Communist Social gathering, down with Xi Jinping,” a crowd in Shanghai shouted within the early hours of Sunday, based on witnesses and movies posted on social media.

It is secure to say that this doesn’t occur fairly often, and the world is watching intently to see how Beijing handles the brewing disaster.

From an instantaneous market perspective, the COVID surge and nationwide unrest snuff out any hope China is about to re-open its financial system. It would not appear that the restrictions can be lifted any time quickly, and progress will proceed to endure.

In that vein, PMI figures on Wednesday are anticipated to point out that Chinese language manufacturing unit and repair sector exercise shrank once more in November, one other signal that Beijing will preserve its unfastened financial coverage stance.

If that’s the case, the yuan is prone to come below renewed stress, particularly after the central financial institution on Friday stated it might minimize the amount of money banks should maintain as reserves, injecting about $70 billion of liquidity into the struggling financial system.

Three key developments that might present extra course to markets on Monday:

– Australia retail gross sales (October)

– Fed’s Williams speaks

– ECB’s Lagarde speaks

Source link