[ad_1]

(Bloomberg) — Beleaguered crypto lenders are being dealt one other blow from Bitcoin miners as they climate the aftermath of the FTX collapse.

Most Learn from Bloomberg

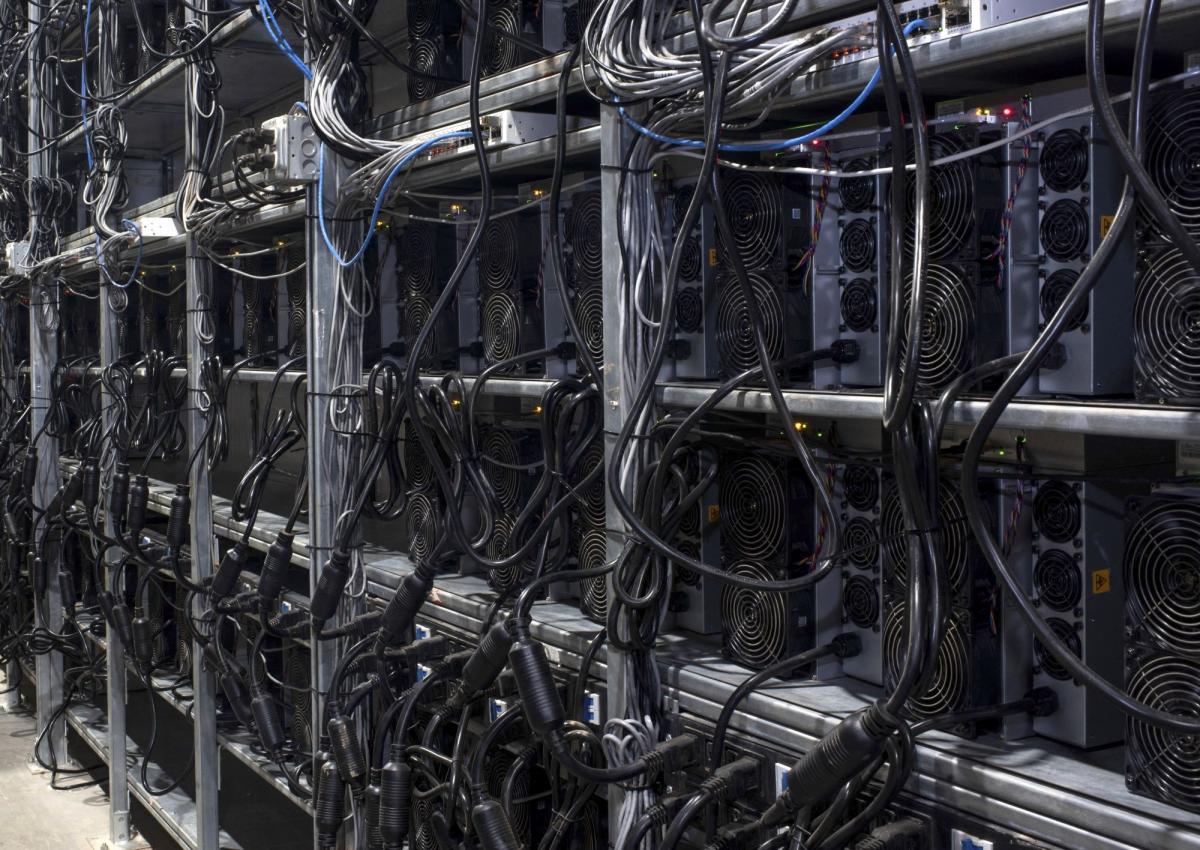

Miners, who raised as a lot as $4 billion from mining-equipment financing when revenue margins had been as excessive as 90%, are defaulting on loans and sending a whole bunch of 1000’s of machines that served as collateral again to lenders. New York Digital Funding Group, Celsius Community, BlockFi Inc., Galaxy Digital, and the Foundry unit of Digital Foreign money Group had been among the many largest suppliers of funding to finance pc tools and construct knowledge facilities.

The liquidity crunch hitting digital-asset markets after FTX failed comes as low Bitcoin costs, hovering power prices and extra competitors weigh on miners. Loans backed by the pc tools, referred to as rigs, had grow to be one of many business’s hottest financing instruments. Many lenders are actually doubtless going through substantial losses since they’ll’t seize another property in addition to the machines, whose worth has dropped by as a lot as 85% since final November.

“Individuals had been pouring {dollars} into the mining area,” stated Ethan Vera, chief operations officer at crypto-mining providers agency Luxor Applied sciences. “Miners ended up dictating numerous the mortgage phrases, so the financiers moved forward with numerous the offers the place solely the machines had been collateral.”

Iris Power Ltd. stated this month it anticipated to default on $108 million of restricted recourse loans, which is usually backed by mining rigs. The publicly-traded miner is a long-time borrower of NYDIG, successful a $71 million mortgage secured by 19,800 rigs as lately as March. That was the miner’s third facility secured by NYDIG, a unit of Stone Ridge Holdings Group. Core Scientific Inc., which has warned of chapter, had $39 million of rig-backed loans with NYDIG, and $54 million with now bankrupt BlockFi, as of September. Stronghold Digital Mining already returned round 26,200 mining rigs in August to eradicate $67 million debt owed to NYDIG.

NYDIG, BlockFi and Celsius didn’t reply to requests for remark. Foundry and Galaxy declined to remark.

There’s more likely to be extra defaults. In comparison with the publicly-listed miners, personal firms at present contribute about 75% of the computing energy for the complete Bitcoin community and most of their rig-backed loans with the lenders stay undisclosed, in line with knowledge from Luxor. Further loans will doubtless come underneath stress if extra personal large-scale miners akin to Compute North file for chapter.

“There hasn’t essentially been the perfect due diligence on whether or not a miner was credit score worthy or not,” stated Matthew Kimmell, digital asset analyst at crypto funding agency CoinShares.

Whereas miners are inclined to default when they’re cash-depleted, some firms could have determined to cease paying the loans even when they nonetheless have money on stability sheets, in line with Luxor’s Vera. The collateral may be price much less now than the remaining funds for some miners.

“It might be an financial choice to stroll away from the financing offers,” Vera stated. “Miners are targeted on how you can survive the following six months moderately than in the event that they want the lender for the following 5 years.”

The miners use highly effective energy-guzzling computer systems to safe the Bitcoin blockchain by validating transaction knowledge and earn rewards within the type of the token. Bitcoin has tumbled about 75% since reaching an all-time excessive in November 2021.

Lenders are already a glut of machines after liquidating rig-backed loans from miners. They face the choice of promoting tools at a steep low cost or discovering knowledge facilities to mine Bitcoin themselves.

That glut means lenders may even see additional losses given how saturated the rig market is already, stated Mason Jappa, chief govt at Blockware Options, which gives mining rig brokerage providers. “There are simply tons of machines sitting unused in every single place.”

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link