[ad_1]

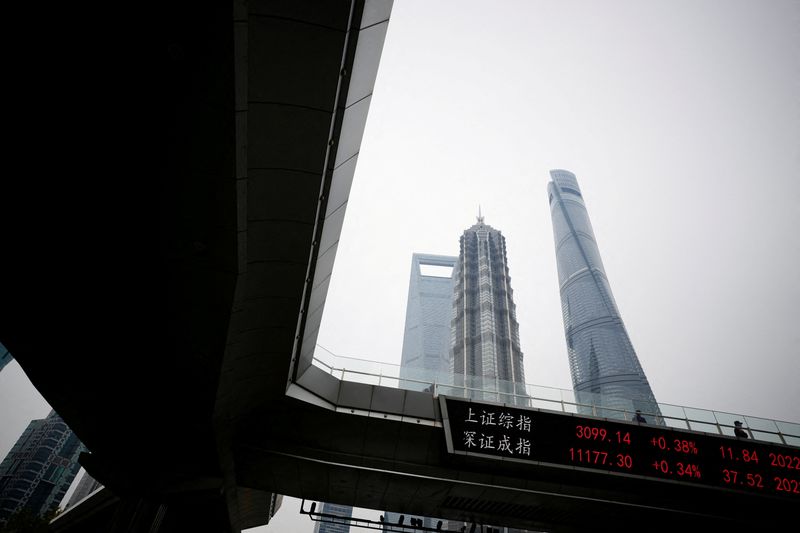

© Reuters. FILE PHOTO: An digital board reveals Shanghai and Shenzhen inventory indexes, on the Lujiazui monetary district, following the coronavirus illness (COVID-19) outbreak, in Shanghai, China November 14, 2022. REUTERS/Aly Tune/File Photograph

By Ankur Banerjee

SINGAPORE (Reuters) – Asian equities jumped on Thursday, whereas the greenback slid as traders poured into dangerous property after Federal Reserve Chair Jerome Powell opened the door to a slowdown within the tempo of financial tightening.

In an eagerly-awaited speech, Powell mentioned the central financial institution may cut back the tempo of its rate of interest hikes “as quickly as December,” however cautioned that the struggle in opposition to inflation was removed from over.

Powell’s feedback on the Brookings Establishment in Washington despatched Wall Road equities hovering, whereas the U.S. greenback and Treasury yields fell.

MSCI’s broadest index of Asia-Pacific shares exterior Japan jumped 2% in early Asian commerce.

The index posted its greatest month-to-month achieve in practically 30 years in November as hopes for a Fed pivot in direction of slower price hikes gathered steam after 4 consecutive 75-basis-point will increase. However the index was nonetheless down about 17.5% on the yr.

opened 1% increased whereas Australia’s rose 0.85%. E-mini futures for the rose 0.20%.

ING regional head of analysis Robert Carnell mentioned it will likely be very onerous now for the Fed to push again in opposition to market expectations for a slowdown in price hikes.

“It appears as if Fed Chair Powell did not get the memo to push again in opposition to pivot hopes and hold monetary situations tight earlier than he went to offer his speech,” he mentioned.

“So let’s hope that inflation does carry on falling, or this will likely appear to be a missed alternative.”

Markets are presently pricing in a 91% likelihood that the Fed will improve charges by 50 foundation factors on Dec. 14, and see a 9% likelihood of one other 75 foundation level hike.

Mainland China shares opened up 1.2% and Hong Kong shares rose 2.5% in early commerce after they closed increased on Wednesday following the easing of COVID-19 measures in Guangzhou metropolis.

China’s manufacturing unit exercise shrank in November as widespread curbs disrupted producers’ output, a non-public sector survey confirmed on Thursday, weighing on employment and financial progress within the third quarter.

U.S. Treasury yields fell after Powell’s feedback and remained decrease Thursday. The yield on was down 8.3 foundation factors at 3.618%, whereas the yield on the 30-year Treasury bond was 6.8 bps decrease at 3.755%.

The 2-year U.S. Treasury yield, which usually strikes in line with rate of interest expectations, was down 5.2 bps at 4.321%.

The safe-haven greenback additionally misplaced its footing, with the – which measures the forex in opposition to six main friends together with the yen and euro – extending Wednesday’s greater than 1% drop into Thursday, dipping as little as 105.69.

The Japanese yen strengthened 1.02% versus the dollar at 136.65 per greenback, whereas sterling was final buying and selling at $1.2086, up 0.25% on the day.

In commodity markets, gold costs climbed to a two-week excessive in early Asian commerce on Thursday. added 0.5% to $1,776.95 an oz, whereas U.S. gained 1.73% to $1,776.20 an oz.

Source link