[ad_1]

There’s been a ton of chatter about wrapped tokens like Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) this week—a few of it reputable, a few of it top-tier shitposting.

Earlier this week, a number of notable crypto Twitter accounts started peddling the concept WETH was on the snapping point.

“ATTENTION: WETH is about to be bancrupt,” tweeted crypto influencer Cygaar. “I’ll begrudgingly bail out anybody holding WETH at a fee of 0.5 ETH per WETH with a purpose to save this house. You possibly can thank me as soon as the disaster has been averted.”

“We’d see a financial institution run on redeeming WETH quickly,” tweeted Gnosis co-founder Martin Köppelmann.

None of this was true.

In contrast to the bank-run tweets that swirled round Twitter amid the FTX collapse, WETH doesn’t have the identical counterparty threat. There isn’t a centralized group custodying the underlying Ethereum. There are not any over-leveraged funds within the Bahamas taking a large threat with person funds.

As a substitute, the important thing threat right here is sensible contract threat.

To mint WETH, customers deposit Ethereum into a wise contract reasonably than giving it to an trade or a crypto lender to carry on to it. The explanation individuals use WETH as an alternative of ETH (in any case, they’re mainly the identical factor, proper?) is that it, not like Ethereum, can also be an ERC-20 token. This makes it a lot simpler to combine into varied decentralized functions.

Thus, there was by no means a threat of insolvency or a financial institution run on this asset. It’s merely one other instance of the reasonably obnoxious humorousness that exists within the trade. Certain, the sensible contract may one way or the other break down, nevertheless it has existed and operated easily for thus lengthy that one thing like that might’ve already occurred by now if there was some form of bug.

WBTC, nonetheless, is way totally different.

“BitGo is the custodian for the BTC backing for wBTC,” wrote Rugdoc.io, a community-driven undertaking that critiques sensible contracts. “Bitgo froze FTX belongings, making a 4k surplus of BTC and the wBTC depeg. It isn’t your Bitcoin in the event you maintain wBTC.”

This asset mainly allows you to create an Ethereum-compatible model of Bitcoin in order that it may be utilized in totally different DeFi functions. Much more merely, it’s an ERC-20 token pegged to the worth of Bitcoin.

It’s additionally backed by actual Bitcoin, which, as talked about above, is custodied by a agency known as BitGo. For each 1 WBTC in circulation, BitGo has 1 actual Bitcoin.

At any time when a person desires to “unwrap” their WBTC and redeem it for the actual deal, they need to undergo a service provider (this might be an trade, for instance). Doing this implies destroying (or burning) that WBTC and withdrawing one of many Bitcoin from custody.

Critically, you can even see this minting and burning exercise occurring on-chain due to a handy dashboard.

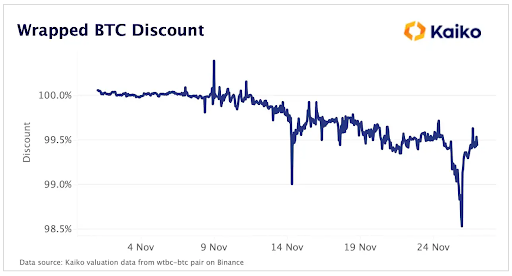

Final week WBTC depegged in value from the underlying Bitcoin, which—given its design—was truly a bit extra worrisome (and never essentially a mean-spirited Twitter joke).

Usually, when a reduction like this emerges, market makers will swoop in and arbitrage the distinction for revenue by shopping for the cheaper WBTC and redeeming it for the actual Bitcoin.

And that’s just about what they’ve been doing right here, too. However as a result of Alameda (the sister buying and selling agency to the collapse FTX) was an enormous WBTC person, their absence left a number of arbitrage to do.

Thus, the market is doing a little bit of catch-up in addition to battling some critical FUD alongside the best way.

Proper now, WBTC is buying and selling at roughly a $15 low cost to the actual deal. That’s peanuts. And it’s probably made some market makers all of the richer alongside the best way.

Decrypting DeFi is our DeFi publication, led by this essay. Subscribers to our emails get to learn the essay earlier than it goes on the positioning. Subscribe right here.

[ad_2]

Source link