[ad_1]

(Bloomberg) — Former Treasury Secretary Lawrence Summers warned that the Federal Reserve will in all probability want to lift rates of interest greater than markets are at present anticipating, because of stubbornly excessive inflationary pressures.

Most Learn from Bloomberg

“We’ve an extended technique to go to get inflation down” to the Fed’s goal, Summers advised Bloomberg Tv’s “Wall Road Week” with David Westin. As for Fed policymakers, “I believe they’re going to wish extra will increase in rates of interest than the market is now judging or than they’re now saying.”

Curiosity-rate futures recommend merchants anticipate the Fed to lift charges to about 5% by Might 2023, in contrast with the present goal vary of three.75% to 4%. Economists anticipate a 50-basis level enhance on the Dec. 13-14 coverage assembly, when Fed officers are additionally scheduled to launch contemporary projections for the important thing price.

“Six is definitely a state of affairs we will write,” Summers mentioned with regard to the height share price for the Fed’s benchmark. “And that tells me that 5 isn’t a great best-guess.”

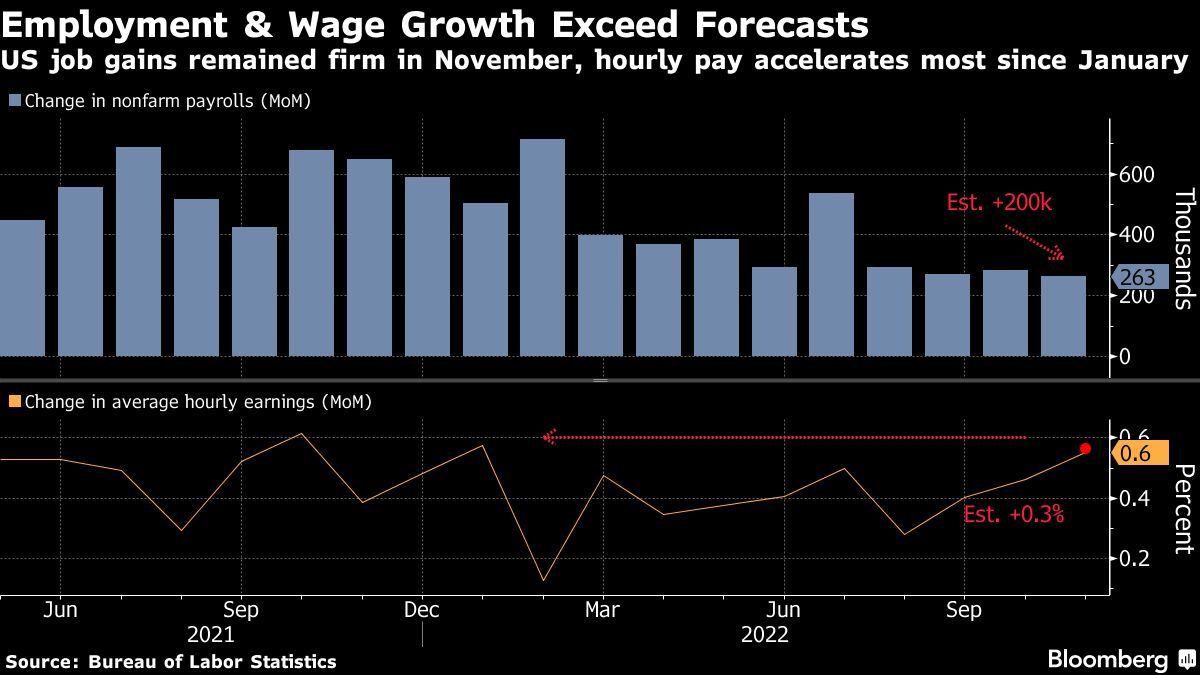

Summers was talking hours after the most recent US month-to-month jobs report confirmed an sudden soar in common hourly earnings positive aspects. He mentioned these figures showcased persevering with robust value pressures within the economic system.

“For my cash, the most effective single measure of core underlying inflation is to take a look at wages,” mentioned Summers, a Harvard College professor and paid contributor to Bloomberg Tv. “My sense is that inflation goes to be somewhat extra sustained than what persons are searching for.”

Learn Extra: Job Market Is Too Tight for Fed Consolation as Labor Pool Shrinks

Common hourly earnings rose 0.6% in November in a broad-based acquire that was the most important since January, and have been up 5.1% from a yr earlier. Wages for manufacturing and nonsupervisory employees climbed 0.7% from the prior month, probably the most in nearly a yr.

Whereas quite a few US indicators have recommended restricted influence so removed from the Fed’s tightening marketing campaign, Summers cautioned that change tends to happen immediately.

“There are all these mechanisms that kick in,” he mentioned. “At a sure level, customers run out of their financial savings after which you might have a Wile E. Coyote type of second,” he mentioned in reference to the cartoon character that falls off a cliff.

Within the housing market, there tends to be a sudden rush of sellers placing their properties in the marketplace when costs begin to drop, he mentioned. And “at a sure level, you see credit score drying up,” forcing compensation issues, he added.

“When you get right into a adverse scenario, there’s an avalanche side — and I feel now we have an actual danger that that’s going to occur sooner or later” for the US economic system, Summers mentioned. “I don’t know when it’s going to return,” he mentioned of a downturn. “However when it kicks in, I believe it’ll be pretty forceful.”

Inflation Goal

The previous Treasury chief additionally warned that “that is going to be a comparatively high-interest-rate recession, not just like the low-interest-rate recessions we’ve seen prior to now.”

Summers reiterated that he didn’t assume the Fed ought to alter its inflation goal to, say, 3%, from the present 2% — partly due to potential credibility points after having allowed inflation to surge so excessive the previous two years.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link