[ad_1]

Amid stubbornly excessive inflation, a record-breaking share of Individuals are turning their 401(ok) accounts into emergency piggy banks, in keeping with Vanguard.

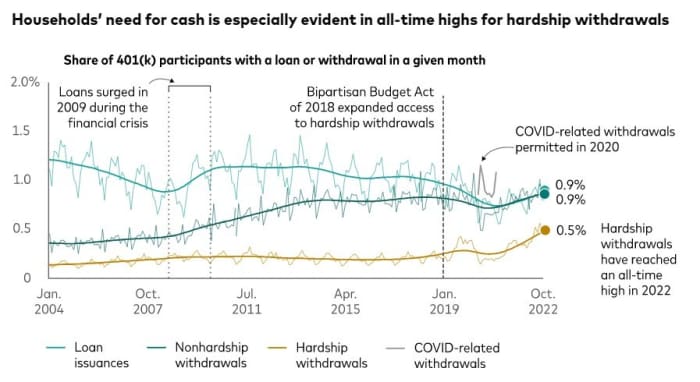

Dissecting information from a pattern of the roughly 5 million employer-sponsored 401(ok) accounts that Vanguard handles, researchers stated 0.5% of account holders had been making hardship withdrawals in October.

That’s a “regarding” all-time excessive, stated Vanguard, the retirement-savings and asset-management heavyweight, providing a view that stretches again to 2004.

For comparability, 0.3% of accounts had hardship withdrawals final October, and through October 2020, the share was 0.2%, Vanguard’s information confirmed. In October 2019, it was 0.4%, it stated.

On the similar time, Vanguard’s numbers present that 401(ok) loans and nonhardship withdrawals are additionally presently rising. In October, 0.9% of 401(ok) plan individuals had loans and one other 0.9% had nonhardship withdrawals.

Vanguard

Constancy Investments can also be seeing an upswing in hardship withdrawals among the many greater than 22 million 401(ok) plan individuals it serves.

Final yr, 1.9% of Constancy’s 401(ok) individuals took a hardship withdrawal, in keeping with Mike Shamrell, the corporate’s vice chairman of thought management. From January to October 2022, the share of individuals taking hardship withdrawals was 2.2% — a determine that, whereas “nonetheless comparatively flat,” is the best fee since 2020, and inflation is among the contributing elements, he famous.

It’s simple to surmise why extra Individuals are resorting to 401(ok) hardship withdrawals, analysts say. Whether or not the financial system reached has peak inflation or not, the price of residing is excessive. In the meantime, financial savings charges are dwindling and credit-card debt is climbing.

Inventory portfolios aren’t providing shelter both. The Dow Jones Industrial Common

DJIA,

is off greater than 7% yr to this point, whereas the S&P 500

SPX,

has dropped greater than 17% and the tech-heavy Nasdaq Composite

COMP,

has declined over 29%.

“The latest improve in households drawing on their employer-sponsored retirement accounts, nevertheless, may very well be an indication of some deterioration within the monetary well being of the U.S. shopper,” stated Fiona Greig, Vanguard’s world head of investor analysis and coverage.

Tax penalties

That may very well be placing it mildly. A number of the tax language, the potential tax penalties and the executive course of required to make a hardship withdrawal present how laborious up a family should be to go forward with the thought.

To take a hardship withdrawal, a 401(ok) account holder wants to indicate their employer they’ve an “speedy and heavy monetary want” for the cash, in keeping with the Inner Income Service. That may be because of bills like medical prices, tuition and funeral bills, the IRS stated.

The quantity requested must be restricted to what’s required to repay that monetary want, the tax company notes.

There’s usually a ten% tax penalty for early withdrawals earlier than age 59½. That price could also be waived for hardship withdrawals, however the distribution continues to be topic to revenue tax. Moreover, an individual who takes a hardship withdrawal can’t pay it again to their 401(ok) and in addition can’t roll it into one other 401(ok) plan or an IRA, the tax company famous.

The monetary pressures confronted by U.S. households are in sharp give attention to Capitol Hill. Sens. Cory Booker, Democrat from New Jersey, and Todd Younger, Republican from Indiana, are hoping for traction on a invoice that might make it simple for employers to arrange emergency financial savings accounts for employees, simply as they do 401(ok) accounts.

The dearth of rainy-day financial savings amongst Individuals is making a state of affairs the place folks have to show to their retirement accounts all too usually, writer and personal-finance adviser Suze Orman stated at an occasion on Tuesday with Booker and Younger.

“We don’t need a scenario the place folks, after they want cash, one thing occurs and so they want cash, they go to their 401(ok)s, or 403(b)s or [Thrift Savings Plan] to take out a mortgage,” Orman stated. “That shall be one of many largest errors they made, however but that’s the place they go for emergency cash.”

Source link