Biden asks U.S. Supreme Court docket to pause second ruling in opposition to pupil debt plan By Reuters

[ad_1]

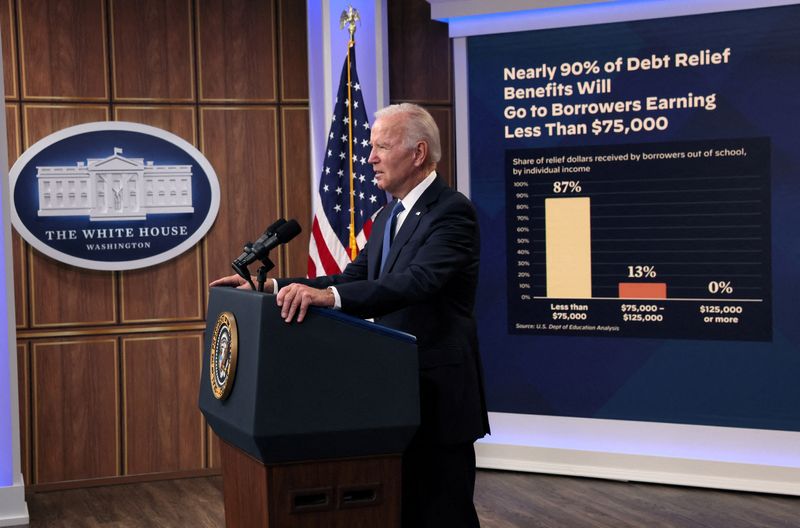

© Reuters. FILE PHOTO: U.S. President Joe Biden delivers remarks concerning the pupil mortgage forgiveness program from an auditorium on the White Home campus in Washington, U.S., October 17, 2022. REUTERS/Leah Millis/

By Andrew Chung

(Reuters) – A day after the U.S. Supreme Court docket agreed to listen to arguments over the legality of President Joe Biden plan to cancel billions of {dollars} in pupil debt, his administration on Friday requested the justices to placed on maintain a choose’s ruling in a separate case that discovered this system illegal.

Rulings by decrease courts in two challenges filed in opposition to the debt reduction program have put Biden’s coverage on ice.

The administration on Friday requested the Supreme Court docket to pause Texas-based U.S. District Choose Mark Pittman’s determination in a problem backed by a conservative advocacy group or to listen to arguments on the deserves of the case on the similar time that it tackles a problem pursued by six principally Republican-led states.

Pittman issued his ruling on Nov. 10. The St. Louis-based eighth U.S. Circuit Court docket of Appeals issued its injunction on Nov. 14 in a lawsuit by which Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina have argued that the administration overstepped its authority.

The justices on Thursday didn’t act on Biden’s request to instantly elevate the eighth Circuit’s injunction however fast-tracked the case for oral arguments in late February or early March.

Biden introduced in August that the U.S. authorities would forgive as much as $10,000 in pupil mortgage debt for debtors making lower than $125,000 a yr, or $250,000 for married {couples}. College students who acquired Pell Grants to profit lower-income school college students could have as much as $20,000 of their debt canceled.

Through the 2020 presidential marketing campaign, Biden promised to assist debt-saddled former school college students however this system has drawn opposition from Republicans and conservative teams who say it’s unfair to those that paid again their loans or by no means went to school and will exacerbate inflation.

The Congressional Funds Workplace in September calculated that the debt forgiveness program would price taxpayers about $400 billion.

The Texas lawsuit was filed by two debtors who have been partially or totally ineligible for the mortgage forgiveness, backed by the Job Creators Community Basis, a conservative advocacy group based by Bernie Marcus, a co-founder of Residence Depot Inc (NYSE:).

Pittman, appointed as a choose by Republican former President Donald Trump, dominated that the administration overstepped its authority to order debt cancellation beneath a 2003 regulation referred to as the Larger Schooling Aid Alternatives for College students Act, which might “waive or modify” pupil monetary help throughout warfare or nationwide emergency.

The choose mentioned it was irrelevant if Biden’s plan was good public coverage as a result of this system was “one of many largest workout routines of legislative energy with out congressional authority within the historical past of the US.”

Biden’s administration justified its plan primarily based on the financial harms inflicted by the COVID-19 pandemic and considerations about rising debt delinquency and decrease earnings, notably amongst lower-income People. Biden and his predecessor Trump had invoked the regulation to pause pupil mortgage repayments.

Biden on Nov. 22 prolonged the reimbursement pause to no later than subsequent June 30 to present the Supreme Court docket time to resolve the case.

The administration has mentioned that greater than 26 million debtors have utilized for mortgage reduction and 16 million purposes have been authorised for discharge if allowed by the courts. It has mentioned greater than 40 million People are eligible for reduction.

Source link