[ad_1]

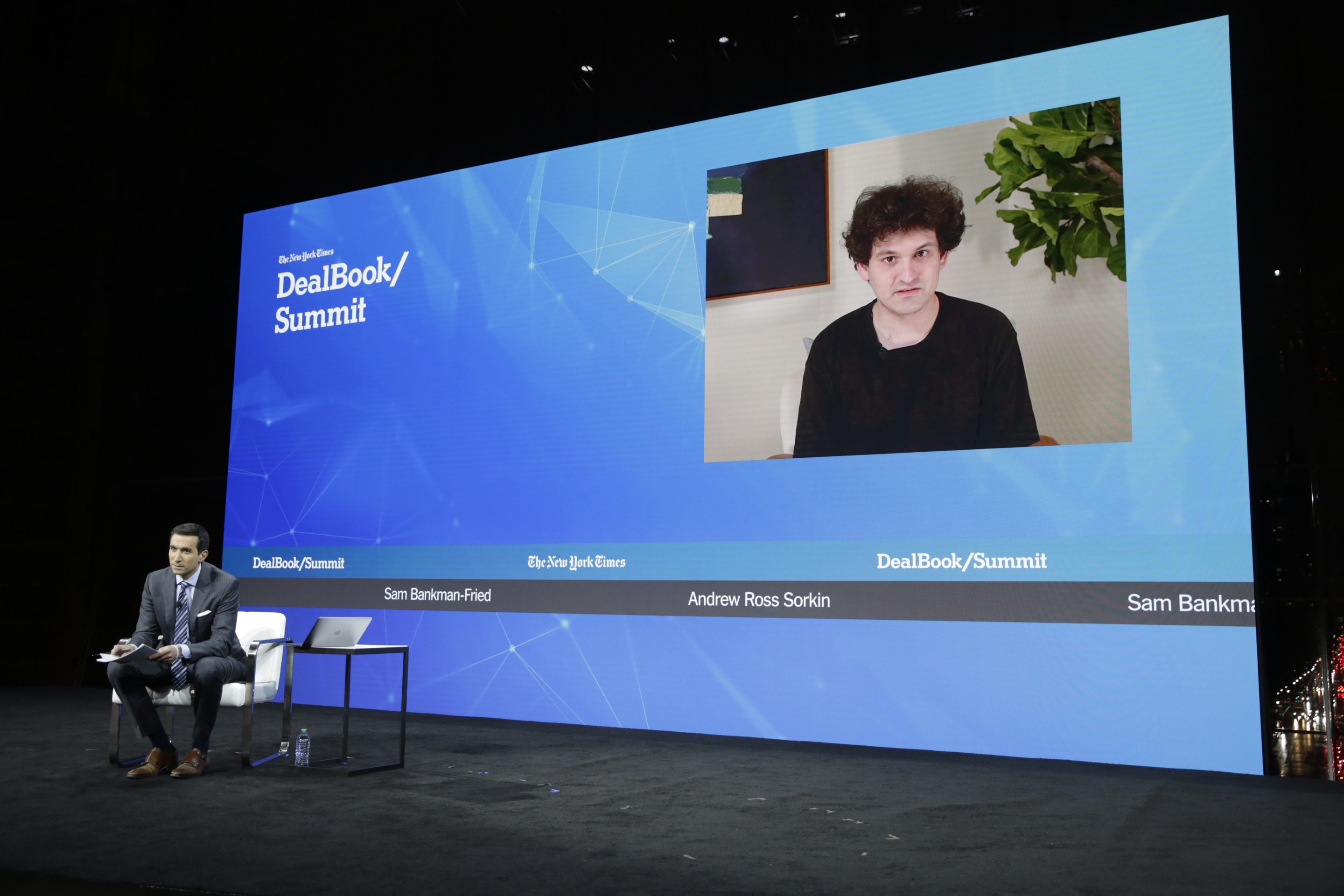

FTX founder Sam Bankman-Fried went on an “I screwed up” media blitz this week, highlighted by his video look on the New York Instances DealBook summit on Wednesday and persevering with into the Sunday discuss exhibits.

U.S. securities lawyer James Murphy, speaking to CNN’s Quest Means Enterprise on Thursday, stated Bankman-Fried “did an excellent job of sticking to his speaking factors.”

Murphy stated: “His speaking factors have been, ‘I didn’t do something mistaken deliberately. I could have been negligent. I could have breached fiduciary obligations.’ However these two issues get you sued, get you penalized. They don’t get you to jail. And so he steered away from something that appeared like intentional misconduct.”

FTX imploded in spectacular vogue final month, spurring requires tighter regulation and shaking confidence within the crypto sector. The $32 billion cryptocurrency trade had established itself as a frontrunner within the discipline, enlisting star athletes like Stephen Curry and different celebrities to bolster its picture.

A key accusation leveled towards Bankman-Fried is that he used buyer funds from his crypto trade to fund dangerous bets at affiliate buying and selling arm Alameda Analysis.

‘Didn’t ever attempt to commit fraud’

Within the DealBook interview, Bankman-Fried peppered his statements with legalese, stating that he “didn’t ever attempt to commit fraud on anybody,” didn’t “know of instances after I lied,” and “didn’t knowingly comingle funds.”

Mentioned Murphy of Bankman-Fried sticking to the script: “He’s a really, very vivid man and managed to try this for an hour.”

In a Monetary Instances interview revealed Sunday, Bankman-Fried caught with the theme, saying, “I f****d up huge and folks acquired harm.”

On ABC’s This Week on Sunday, Bankman-Fried stated, “Look, I screwed up. Like I used to be CEO, I had a accountability right here and a accountability to be on high of what was occurring the trade. I want I had accomplished significantly better at that.”

ABC authorized analyst Dan Abrams stated afterwards, “His primary protection, it seems like, is, ‘I didn’t have the intent. I wasn’t attempting to do it.’ That’s not sufficient in a variety of instances. That’s not going to guard him essentially from getting indicted. However it’s one thing we hear from CEOs who get tried, and it virtually by no means works.”

‘Folks will go to jail, and may go to jail’

Abrams added that Bankman-Fried could possibly be dealing with a very long time in jail.

“We’re speaking about, by the best way, the potential of as much as life in jail,” he stated. “Whenever you’re speaking about this a lot cash, within the federal sentencing pointers, you’re speaking about the potential of enhancement after enhancement after enhancement primarily based on the greenback quantities that would result in one thing as much as life.”

Earlier this week Coinbase CEO Brian Armstrong stated of Bankman-Fried, it’s “baffling to me why he’s not in custody already.”

Mark Cuban, billionaire proprietor of the Dallas Mavericks and a distinguished crypto investor, lately informed TMZ that Bankman-Fried must be nervous about jail time.

Mike Novogratz, CEO of crypto agency Galaxy Digital Holdings, informed Bloomberg TV on Thursday, “Sam and his cohorts perpetuated a fraud…He took our cash. And so he must get prosecuted. Folks will go to jail, and may go to jail.”

Securities lawyer Murphy added that prosecutors don’t must show that there was securities fraud. “They’ll go together with mail and wire fraud,” he stated. “If the cash of consumers was misappropriated and given to this affiliated firm Alameda, that may be a fraud and may qualify underneath the statues. I sincerely hope our Division of Justice is it very exhausting.”

Fortune reached out to Bankman-Fried however didn’t obtain a right away reply.

Our new weekly Influence Report e-newsletter will look at how ESG information and traits are shaping the roles and obligations of as we speak’s executives—and the way they’ll finest navigate these challenges. Subscribe right here.

[ad_2]

Source link